As AMI representatives travel to Euronaval this month, we are expanding on last month’s coverage of submarine construction to a broader look at European naval shipbuilding. While it is still early to expect major program changes, we have noted several developments that potentially signal shifts in the region’s naval construction landscape in reaction to a deteriorating security situation in Eastern Europe. This editorial also gives us a chance to revisit changes we anticipated months ago with the beginning of the war in Ukraine. As it appears that conflict will last some time, it is anticipated there will be longer term implications for naval industry in Europe.

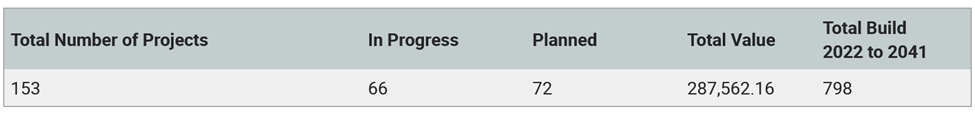

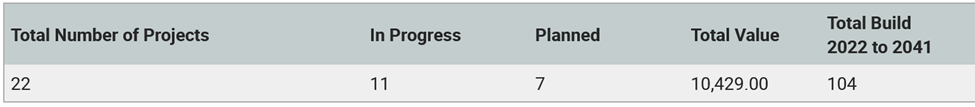

AMI’s forecast for NATO and non-NATO European shipbuilding for the next 20 years remains steady, showing few changes from the expected increases in defense spending as a result of Ukraine. Our 20-year snapshot (below) is a “pre-war” look at the regional market:

NATO (Less US):

Non-NATO Europe (led by Sweden and Finland)

Taken together, these two regions contribute about 30% of forecasted new ship acquisitions worldwide over the next two decades, as measured by acquisition value. These regional 20-year forecasts have not changed appreciably over the past 10 years, despite the deterioration of the security environment in Europe, accelerated by Russia’s 2014 annexation of the Crimea, and now other parts of Ukraine.

As shown by the chart below, the top five countries for forecasted new construction spending on the continent represent just over 50% of total regional numbers. Canada, led by its new frigate program, accounts for another 25% of total NATO forecasted spend, measured in millions of US dollars:

| Country | US$M |

| UK | 64060 |

| France | 29765 |

| Germany | 24295.9 |

| Italy | 24076 |

| Turkey | 19764 |

| Total | 161960.9 |

While the war in Ukraine has permanently altered the continent’s security landscape, notably with the accession of Sweden and Finland into NATO, the prospects for marked increases in European naval shipbuilding thus far remain aspirational. As naval programs have long lead times and program durations, we would not expect to see a Ukraine-driven increase in new ship acquisitions for at least one to two more years. This will be complicated by inflationary and recessionary forces at work on the region’s economies, which will further complicate prospects for defense budget increases.

A review of this month’s articles show more continuity than change with post-Cold War naval underinvestment in Europe, as programs in Greece and Finland are delayed or postponed. On the plus side of the naval shipbuilding ledger is movement on the Netherlands future submarine program, new corvettes for Ukraine, and continued Italian commitments to large amphibious ships.

We note several structural developments in the region’s naval shipbuilding this year that signal a shift away from past patterns of (low) naval budgeting and building:

- Denmark appears to be changing its defense policy and shipbuilding infrastructure plans, with new investments (over US$5B) for shipbuilding infrastructure and new ships.

- German company TKMS has acquired new yards-MV Werften and Rostok-to improve shipbuilding capacity and maintenance and repair. While this is mostly commercial, naval work will also benefit from the new capacity.

- Finland is reportedly raising its defense budget for 2023 by 20%.

- European collaboration on new naval programs continues with Fincantieri, Navantia and Naval Group engaged in the European Patrol Corvette (EPC) program, and Norway and Germany cooperating on a new submarine program.

- Renewed UK naval export momentum with Babcock awarded the Polish Frigate program and Indonesia’s Arrowhead 140, as well as BAE wins in Canada and Australia.

- Italy is conducting a major fleet renewal which will benefit Fincantieri’s local yards.

- Turkey is building MILGEMs for Ukraine and Pakistan and the future indigenous submarine, MILDEN is planned. The Anadolu LHD will commission by the end of the year.

Over the next few months, we will draw on our industry insights and proprietary data on naval shipbuilders to take a detailed look at Europe’s naval industry. We plan several regional reviews, beginning with the Baltic (Sweden, Finland, Poland), then Northern Europe (UK, Germany, Netherlands) and finally Western & Southern Europe (Italy, Spain, France). Meanwhile, we look forward to seeing you at Euronaval!