In the wake of Russia’s invasion of Ukraine, long-simmering tensions in European security have erupted into active war, shifting perceptions of national and regional security requirements. The situation in Ukraine has also prompted many European countries to address long-standing defense vulnerabilities with increased spending. These moves promise to alter fundamentally the conditions in the European defense market over the coming years.

While most of the attention since February 24 has focused on Russian ground and air/missile capabilities and shortfalls, the naval dimension of the Ukraine war will also factor in future European naval spending. Russia’s evidently successful employment of amphibious forces, and offshore missile strikes from naval ships reflect capabilities and tactics demonstrated in Georgia, Crimea and Syria over the past decade. Europe’s naval and national security professionals will seek to counter those capabilities in current and future naval acquisition programs.

In this editorial AMI looks at the current state of European naval programs and considers possible Ukraine-driven changes in three areas of the naval market:

- Expanding current programs.

- Adding new programs.

- Adding or reprioritizing capabilities such as offshore missile deterrents, naval ballistic missile defense, and anti-amphibious systems and weapons.

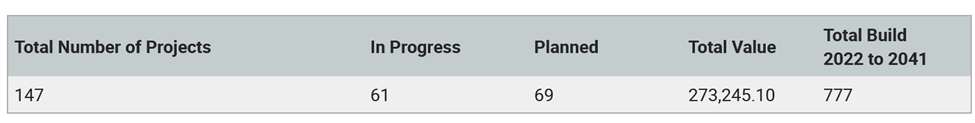

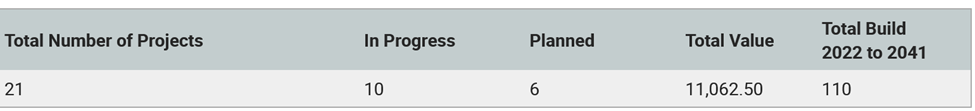

Expanding Current Programs: Currently AMI forecasts that the European region will acquire almost 1,000 new ships and craft over the next two decades, representing almost US$300B in new acquisition spending.

NATO (less US)

Non-NATO Europe

Looking at the mix of ships among future acquisitions, we would expect additional funding to shift to the high end of the capability spectrum—namely frigates and submarines. Submarines in particular appear good candidates for program expansion as well as accelerating schedules for new builds, given their ability to both deter and to interdict sea lines of communication for opposing naval and commercial fleets.

However, such expansions and rescheduling will be constrained by limited naval shipbuilding infrastructure that has been allowed to atrophy in Europe over the past three decades. Those constraints could prompt more regional cooperative programs to make best use of existing naval and commercial shipbuilding capacity.

Adding New Programs: While increases in naval spending are most likely to be first seen in existing programs, adding new programs is also an option to address naval capability shortfalls. The prolonged nature of most European naval procurement processes is an obstacle to adding programs, but new threat perceptions may shorten some of those timelines.

Adding or Reprioritizing Capabilities: Given Russian investments in precision missile strike capabilities from naval ships, missile defense is expected to take on new urgency in European naval procurements. The recent news that the UK Type 45 will receive BMD upgrades to its Sea Viper missile is an example. Additional investment in sensor and communications systems for BMD are also expected. On the offensive side of the ledger, additional funding for ship-based missiles, including hypersonic systems, would enable outnumbered navies to put Russian amphibious forces at risk. “Low end” investments in autonomous undersea, surface and air platforms are also attractive near-term asymmetric options to exploit Russian vulnerabilities.

The overarching question remains: how long will it last? That is, is the Ukraine conflict really a sea-change in the European commitments to boost defense spending and halt the prolonged slow decline that has marked naval force structures in the region since the collapse of the Soviet Union 30 years ago? AMI’s market intelligence reporting will remain an authoritative resource to answer that question as we continue our daily work to track changes in the region’s naval market.